Syndicated post from InmanNews.

Source link

Fannie Mae survey echoes polls by the University of Michigan and the Conference Board that found uncertainty over tariffs is weighing on consumer confidence.

Real estate is changing fast, and so must you. Inman Connect San Diego is where you turn uncertainty into strategy — with real talk, real tools and the connections that matter. If you’re serious about staying ahead of the game, this is where you need to be. Register now!

After hitting its highest level of the year in May, consumer sentiment toward housing deteriorated in June as Americans became more concerned about losing their jobs and less certain that mortgage rates will come down in the next year.

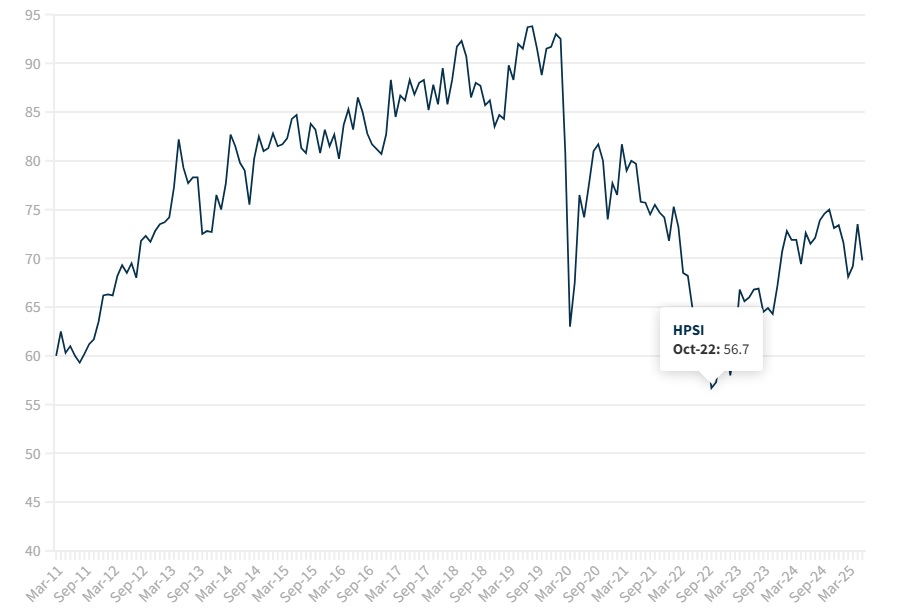

At 69.8, Fannie Mae’s Home Purchase Sentiment Index (HPSI) was down 3.7 points from May to June and 2.8 points from a year ago, the mortgage giant announced Monday.

The decline in Fannie Mae’s HPSI echoes consumer sentiment surveys conducted in June by the University of Michigan and the Conference Board, which showed uncertainty over tariffs weighing on consumer confidence. Consumers are currently paying an average effective tariff rate on imports of 15.8 percent — the highest since 1936, according to a June 17 analysis by The Budget Lab at Yale.

The Trump administration has delayed until Aug. 1 additional country-specific “reciprocal tariffs” that had already been postponed once to July 9. The White House said Monday that 14 countries were notified that they’ll face reciprocal tariffs next month, with additional notifications to go out in the days ahead, CNBC reported.

Goods from Japan and South Korea will be hit with a 25 percent import tax on Aug. 1, for instance, Trump informed the countries in letters shared on Truth Social.

“Tariffs remained on top of consumers’ minds and were frequently associated with concerns about their negative impacts on the economy and prices,” Conference Board Senior Economist Stephanie Guichard said in a statement. “Inflation and high prices were another important concern cited by consumers in June.”

Fannie Mae HPSI tracks consumer housing sentiment

Source: Fannie Mae National Housing Survey, June 2025.

Launched in 2011, Fannie Mae’s HPSI distills six questions from the mortgage giant’s monthly National Housing Survey into a single number.

The index plummeted in the spring of 2020 at the outset of the COVID-19 pandemic and hit an all-time low of 56.7 in October 2022, when home prices and mortgage rates were climbing.

At its current level, the HPSI is about where it was in the summer of 2012, when home purchase sentiment was rebounding from the 2007-2009 housing crash and Great Recession.

While “similar in spirit” to the University of Michigan and Conference Board surveys, the HPSI “is specifically devoted to the housing market,” and increases in the index “have been quite reliably followed by stronger housing markets,” Fannie Mae researchers said in an overview.

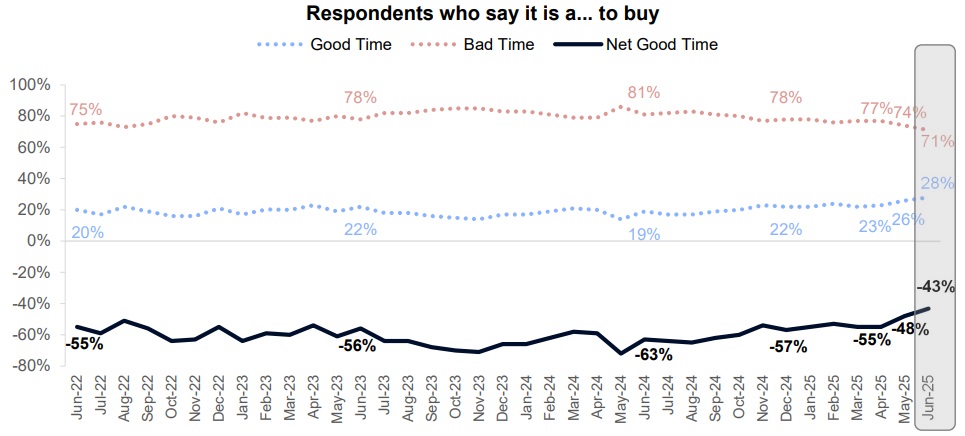

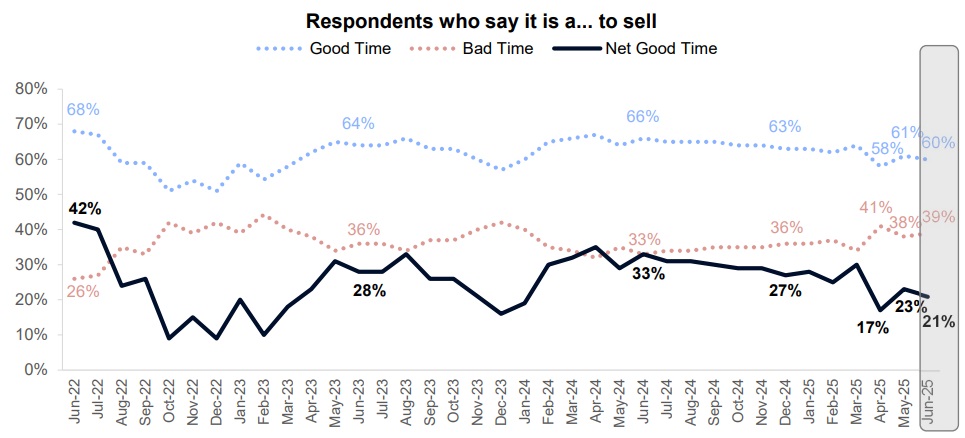

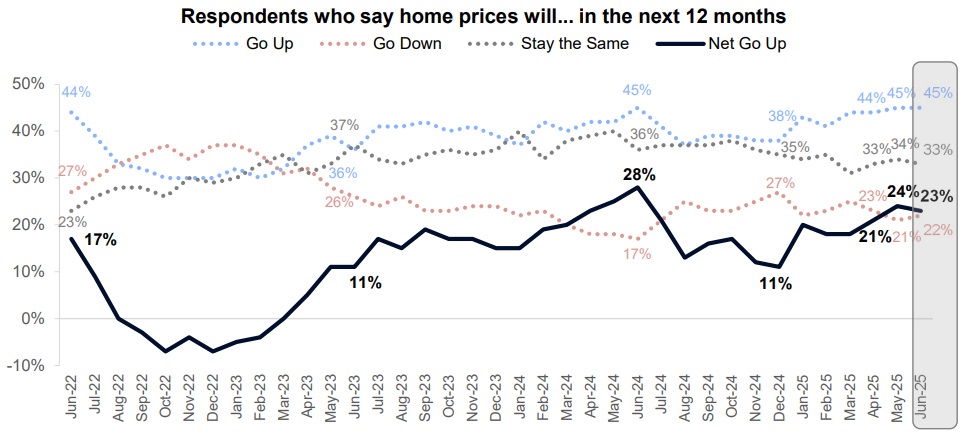

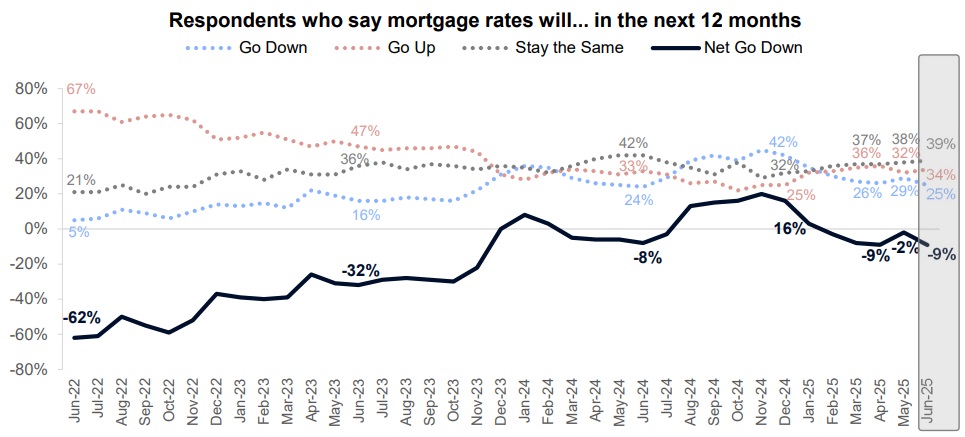

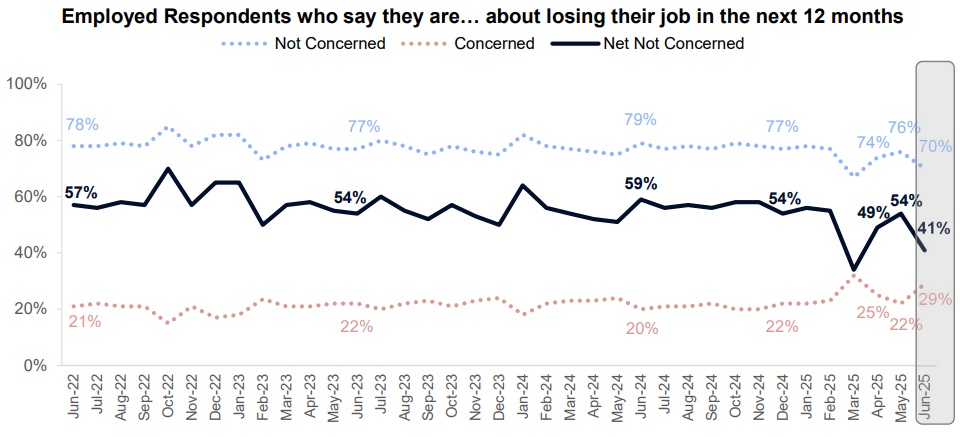

Five out of six HPSI components decreased in June. In addition to being more worried about losing their jobs and less convinced mortgage rates will fall, Americans were less certain that home prices will keep rising in the year ahead and that conditions are good for sellers.

Source: Fannie Mae National Housing Survey, June 2025.

While just 28 percent of the 1,313 household financial decision makers surveyed by Fannie Mae between June 1 and June 17 said it was a good time to buy, that’s up two percentage points from May and nine percentage points from a year ago.

Source: Fannie Mae National Housing Survey, June 2025.

Although six in 10 Americans surveyed in June (60 percent) said it was a good time to sell, that’s down from 61 percent in May and 66 percent a year ago.

Source: Fannie Mae National Housing Survey, June 2025.

The share of survey respondents who expect home prices will go up in the next 12 months was unchanged in June at 45 percent.

But the share who said they expect home prices to go down — 22 percent — was up one percentage point from May and five percentage points from a year ago.

Although falling home prices might help boost sales, Fannie Mae’s HPSI treats a decline in home price expectations as a negative for consumer housing sentiment.

Source: Fannie Mae National Housing Survey, June 2025.

While close to one in three Americans (29 percent) surveyed in May said they expected mortgage rates to come down in the year ahead, that share dropped to 25 percent in June.

The Federal Reserve is expected to hold short-term interest rates steady until September, as policymakers assess the impact of the Trump administration’s tariffs, tax cuts, deregulation and deportations.

Fannie Mae economists last month predicted mortgage rates will drop to 6.5 percent by Q4 2025 and to 6.1 percent by the end of next year. Forecasters at the Mortgage Bankers Association have a more cautious outlook, predicting rates for 30-year fixed rate loans will end the year at 6.7 percent and drop to 6.4 percent by the end of next year.

Source: Fannie Mae National Housing Survey, June 2025.

Although only 29 percent of Americans polled in June said they were concerned about losing their jobs, that’s up from 22 percent in May and 20 percent a year ago.

At 4.1 percent, the unemployment rate in June was down slightly from 4.2 percent in May. But 7 million Americans were out of work, an increase of 1 million from June 2023.

Although not factored into the HPSI, 67 percent of household decision makers surveyed in June said they thought the economy was on the wrong track, up from 64 percent in May.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.