Syndicated post from InmanNews.

Source link

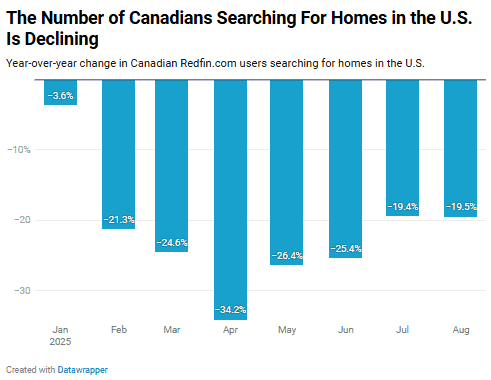

Canadians are losing interest in U.S. real estate, according to Redfin’s latest market report. The share of Canadians searching for U.S. properties declined 19.5 percent year over year in August, extending a six-month trend that started when President Trump announced a 25 percent tariff on Canadian goods in February.

Canadians are losing interest in U.S. real estate, according to Redfin’s latest market report.

The share of Canadians searching for U.S. properties declined 19.5 percent year over year in August, extending a six-month trend that started when President Trump announced a 25 percent tariff on Canadian goods in February.

The Trump Administration raised tariffs on Canada again in July, bumping them to 35 percent, except for goods covered by the United States-Mexico-Canada Agreement (USMCA). Although wood is protected in the USMCA, homebuilders are still paying duties of 27.3 percent, a previous Inman article explained.

Demand has dropped in 46 of the 50 largest markets, the report said, with Canadians primarily pulling back from properties in Florida.

Credit: Redfin

West Palm Beach (-26.6 percent), Tampa (-23.1 percent), and Orlando (-23 percent) were among the top 10 cities with the largest declines, with Anaheim (-26 percent), Columbus, Ohio (-25.6 percent), Detroit (-25.5 percent), Los Angeles (-25.5 percent), San Diego (-25.2 percent), Washington D.C. (-24.4 percent) and New York (-22.3 percent) rounding out the list.

Although foreign policy significantly impacted the decrease in searches for Florida properties, Redfin said booming insurance premiums, homeowners association fees and property taxes, alongside worsening climate risks, also have a part to play.

“One Canadian client is in the process of selling his last U.S. property because he no longer sees it as a good place to invest or vacation,” Las Vegas-based Redfin partner Cheryl Van Elsis said in a written statement. “He used to own four homes in the Las Vegas area, which he mainly rented to fellow Canadians here for casinos or poker events. But now, he no longer wants ties to the U.S.”

The report also said that the weakness of the Canadian dollar is a contributing factor, with the latest conversion rate showing that 1 USD equals 0.72 CAD.

That has made it more difficult for Canadians to afford U.S. properties, especially new builds, whose cost has gone up due to tariffs on countries like Canada that supply the lion’s share of building materials.

In August, the National Association of Home Builders asked President Trump to rethink his trade policy, saying that it’s exacerbating affordability issues.

The Association said the typical new single-family home requires 15,000 board feet of framing lumber, 6,800 square feet of oriented strand board (OSB), a moisture-resistant engineered wood panel similar to plywood, and 2,200 square feet of plywood.

The previous administration’s tariff policy led to a $30,000 increase in the price of a typical new single-family home, NAHB said, as lumber futures and the cost of concrete, gypsum, steel and power transformers have increased by the double digits since 2021.

“With housing affordability already near a historic low, NAHB continues to call on the Trump administration to carefully consider how placing additional tariffs on lumber and other building materials will raise housing prices and impact housing supply,” NAHB said in a previous Inman article. “We are also urging the administration to move immediately to enter into negotiations with Canada on a new softwood lumber agreement that will provide a fair and equitable solution to all parties and eliminate tariffs altogether.”