Syndicated post from InmanNews.

Source link

Quick Read

- Fannie Mae President and CEO Priscilla Almodovar has stepped down; COO Peter Akwaboah is named interim CEO as the board searches for a permanent successor.

- Newly appointed Co-Presidents Brandon Hamara and John Roscoe will lead alongside Akwaboah, with Hamara also overseeing single-family and multifamily operations starting November.

- Congress limits CEO base salary to $600,000, complicating search for permanent CEO.

An AI tool created this summary, which was based on the text of the article and checked by an editor.

Fannie Mae President and CEO Priscilla Almodovar has been replaced on an interim basis by Chief Operating Officer Peter Akwaboah. FHFA Director Bill Pulte fired Freddie Mac CEO Diana Reid in March after board shakeup.

Fannie Mae President and CEO Priscilla Almodovar is no longer serving in that role and has been replaced on an interim basis by Chief Operating Officer Peter Akwaboah, the mortgage giant announced Wednesday evening.

“Peter’s deep operating background, as the former Morgan Stanley COO of Global Technology, makes him the perfect fit for the Acting CEO position while the Board conducts its search for a permanent CEO,” Federal Housing Finance Agency Bill Pulte said in a statement.

Pulte fired Freddie Mac CEO Diana Reid in March, just days after shaking up Fannie and Freddie’s boards of directors by firing 14 board members and naming himself chair of both companies.

Priscilla Almodovar

Almodovar, a former JP Morgan Chase executive who took the CEO reins at Fannie Mae in 2022, said in a statement that holding the job was “the privilege of a lifetime.”

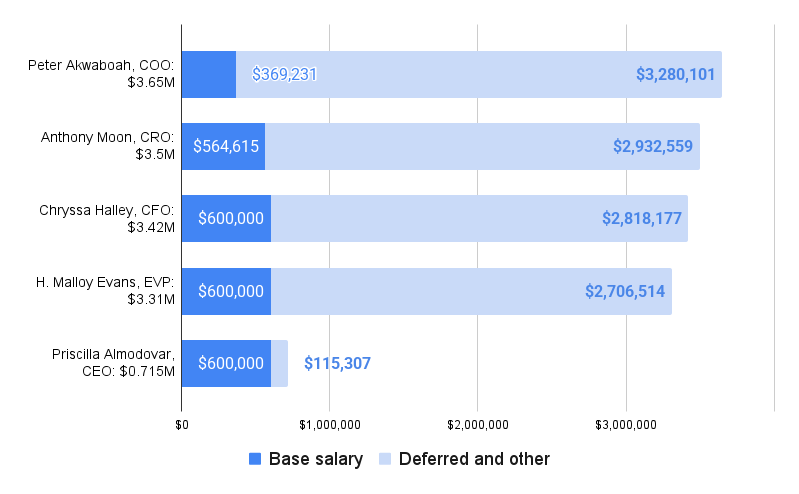

If Akwaboah wants to keep the CEO job on a permanent basis, it would mean taking a pay cut of about $3 million, as Congress has capped the base pay of each company’s CEO to a base salary of $600,000 a year.

Fannie Mae 2024 executive compensation

Fannie Mae 2024 executive compensation. Source: Fannie Mae 2024 annual report

Other “named executives” can receive deferred compensation on top of their base salary, some of which is based on performance. That means the CEO is the lowest-paid of top executives at both companies.

Democrats have questioned the legality of Pulte’s purge of Fannie and Freddie’s boards, but the housing scion has used his powers to whip Fannie and Freddie into shape for a public offering by the end of the year. (Pulte announced Tuesday he will donate his $180,000 annual salary as FHFA director to wounded veterans).

New additions to Fannie and Freddie’s boards in March included Mike Stucky, a former Pulte Group division president; Tri Pointe Homes Inc. executive Brandon Hamara; and Ralph “Cody” Kittle, a partner at private equity firm RenWave Kore.

In April, Pulte appointed banker and investor Omeed Malik — dubbed “MAGA world’s premier financier” by New York Magazine — to Fannie’s board.

Barry Habib, founder and CEO of mortgage software platform MBS Highway, was appointed to the board on July 21.

As part of the Trump administration’s goal to use Fannie and Freddie to spur homebuilders into action, Hamara will also serve as Fannie Mae’s head of operations for single-family and multifamily starting in November.

His total annual target direct compensation will be $1.9 million, consisting of base salary of $525,000, fixed deferred salary of $805,000 and at-risk deferred salary of $570,000, Fannie Mae disclosed in an Oct. 8 regulatory filing.

Malik will serve on Fannie Mae’s nominating and corporate governance committee and Habib on the compensation and human capital committee, Fannie Mae reported on Oct. 10.

Fannie Mae said Wednesday that with Almodovar departing, Hamara will serve as the company’s co-president along with John Roscoe, a former FHFA chief of staff who was hired as Fannie Mae’s executive vice president for operations and public relations in April.

As chief of staff, Roscoe and his superior, FHFA director Mark Calabria, were investigated by the FHFA’s Office of the Inspector General (OIG) for seeking a $250,000 retention bonus for a Fannie Mae executive.

The FHFA OIG found that the bonus was a “retention award in name only” and the agency ultimately determined that it should not be paid.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.