Syndicated post from InmanNews.

Source link

In 2026, affordable housing is the problem everyone seems to have an opinion on, but no one seems to actually know how to solve in a swift and long-lasting way. Real estate agents have to wonder whether affordable housing’s fate is similar to that of the dodo: Are we just going to keep letting affordable housing options fall off a cliff until it’s extinct?

The last time housing was considered “affordable” for many Americans was during the painful correction following the 2008 financial crisis, from 2010 to 2012. Since then, home values have risen steadily, alongside inflation and the overall cost of living.

What hasn’t kept pace? The average American’s paycheck. The result is a widening gap between what housing costs and what working households can realistically afford.

Real estate agents are seeing the consequences up close, and for those who specialize in traditional residential real estate, the affordable housing crisis feels more than personal. Younger, active buyers are increasingly sidelined, not because they lack desire or buy too much avocado toast, but because the math of what it takes to qualify for a mortgage no longer works.

Even when interest rates ease, many first-time buyers remain excluded from homeownership in the communities where they live and work.

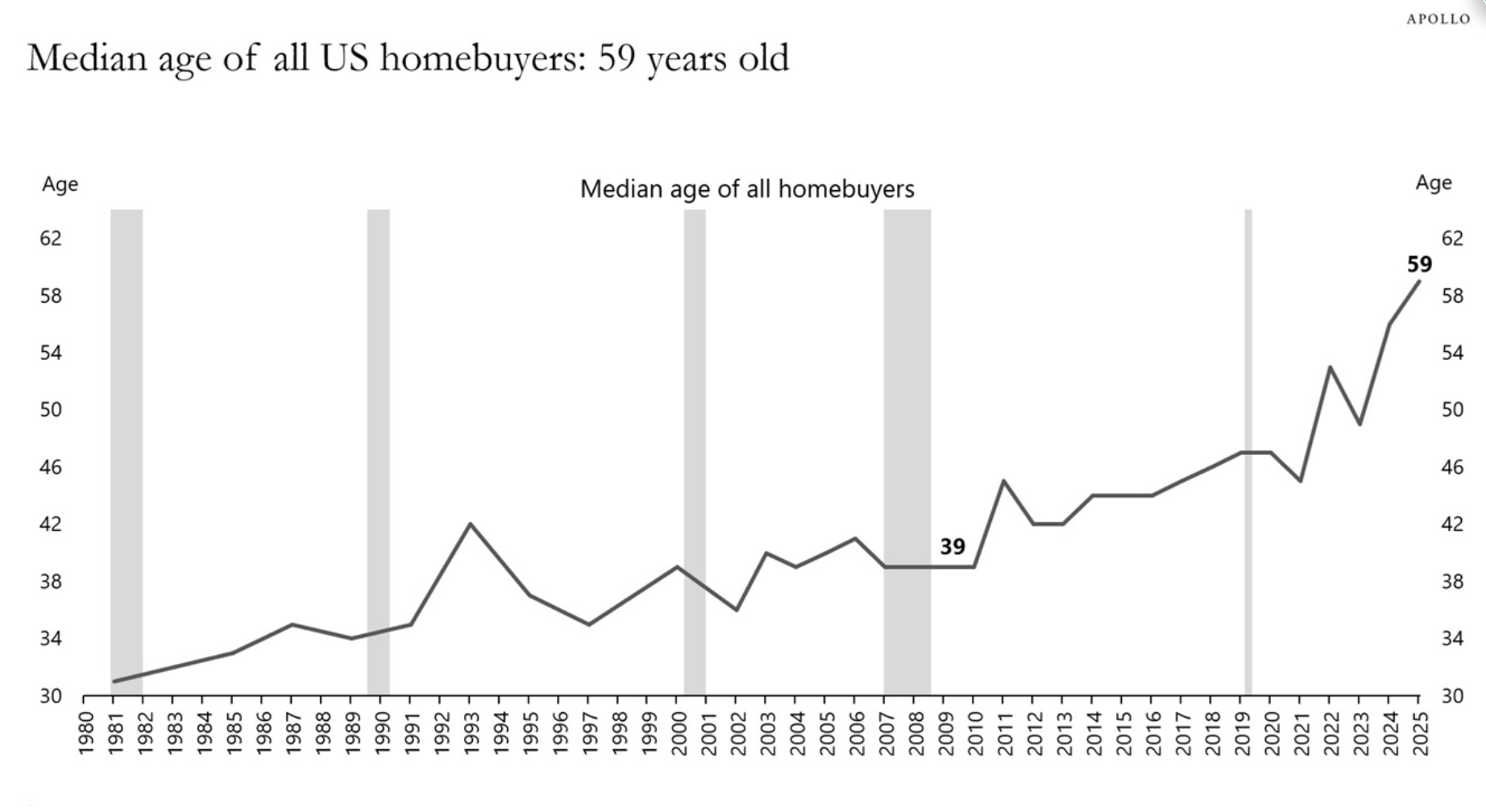

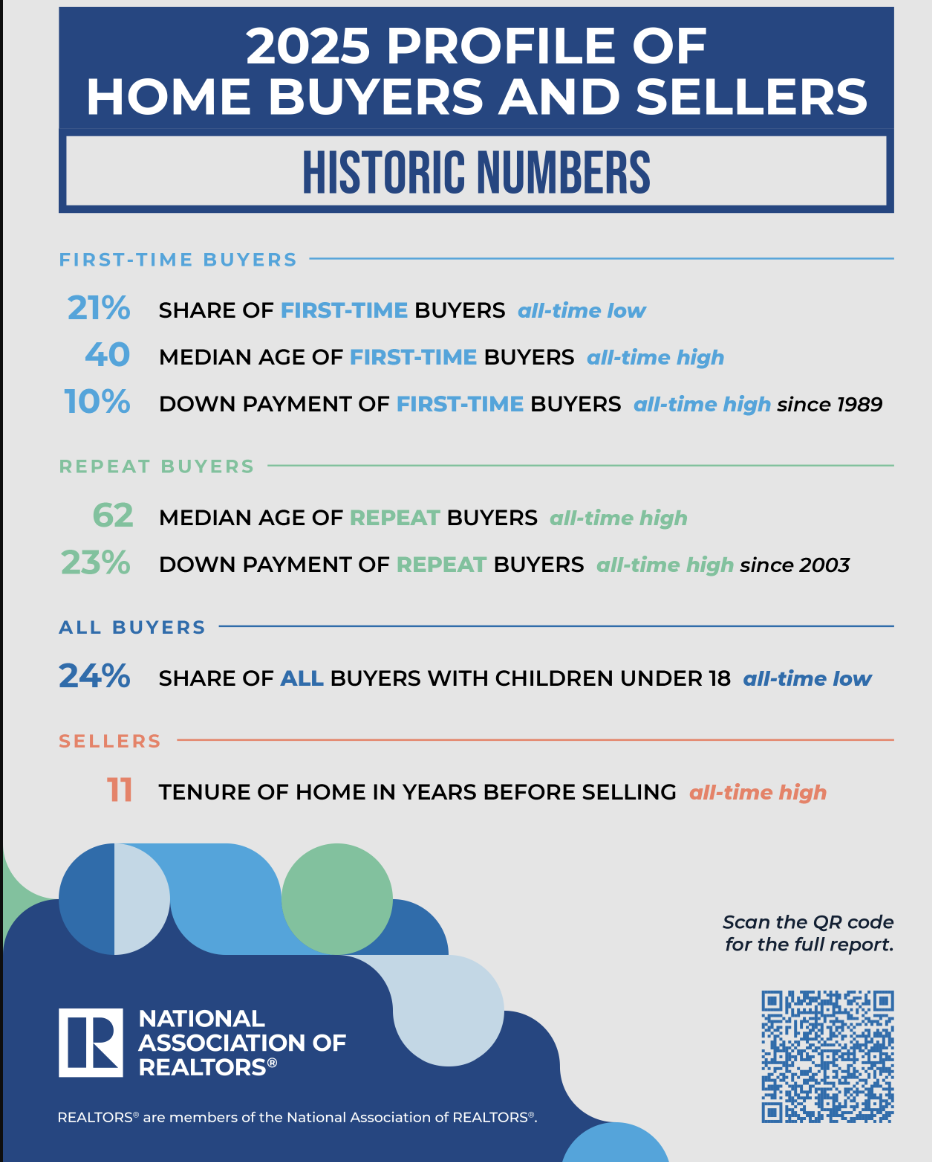

The current Trump administration’s narrative on affordable housing is the exact opposite of what buyers need: “I want to drive prices up for those who own their homes” offers little comfort to renters watching rents rise, savings shrink and buying power recede faster than their hairlines (the median age of a first-time homebuyer is now 40), and it leaves a sour taste in everyone’s mouth.

Parties on both sides of the aisle are frustrated and working on reform, but without a basic understanding of what most Americans need, even this new hopeful legislation is likely to be dead on arrival if everyone isn’t willing to address the issues that are creating the problem to begin with.

Affordable housing is now caught in what economists describe as a polycrisis: multiple, interconnected crises that reinforce one another and turn short-term shocks into long-term instability. Housing affordability in 2026 isn’t just a housing problem. It’s the convergence of three systemic pressures that households feel every day.

The trifecta is creating the squeeze

ChatGPT-generated image

1. The cost crisis

Everyday essentials — housing, insurance, transportation, food and utilities — remain stubbornly expensive, according to AARP. With retirees trying to stretch every dollar, you can bet that the AARP is keeping tabs on inflation for folks who are coasting on assets and pensions.

Even modest homes now carry monthly costs that rival luxury payments from just a decade ago. For many households, shelter alone consumes far more than the recommended share of income, leaving little buffer for emergencies.

2. The wage crisis

Income growth has not kept pace with the cost of living. USA Today recently surveyed American sentiment on jobs and the cost of living, and the majority of Americans agree that conditions are not great and are not looking hopeful for the rest of 2026.

With 42 percent of younger Americans working paycheck to paycheck, they feel that one medical bill, car repair or rent increase away from falling behind.

The data from Goldman Sachs Asset Management found the following:

“For instance, homeownership now eats up 51% of income, up from 33% in 2000, while health care costs account for 16% of after-tax earnings, up from 10% a quarter century ago … “

3. The care crisis

Child care, health care and elder care costs are straining household budgets, even as people are being asked to save more for down payments and retirement. The cost of caregiving was the number one reason women had to leave the workforce in 2025, which significantly reduced household income, as individuals need to qualify for a mortgage.

The Johns Hopkins Bloomberg School of Public Health just released data on the effects of higher insurance costs this year and how this increase will ripple out.

Together, these forces create a loop: high costs and stagnant wages reduce savings, limited savings delay ownership, delayed ownership fuels long-term renting and rising rents further erode the ability to save.

What the data keeps telling us

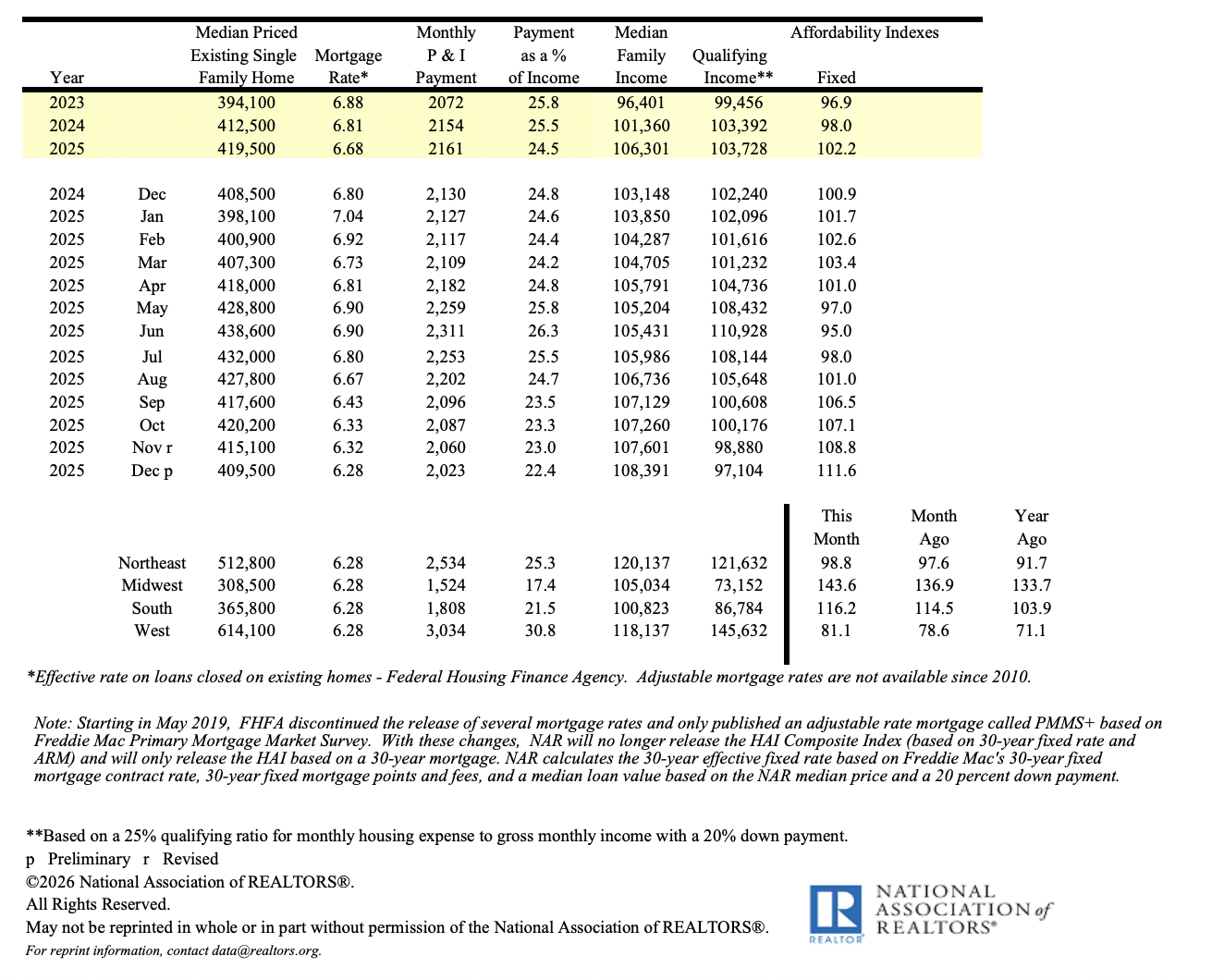

The National Association of Realtors’ affordability measures have long signaled this reality. The median income required to purchase a home in many markets now exceeds the median household income. Homebuyers are getting older, and first-time buyers are shrinking as a share of total transactions.

Meanwhile, renting is becoming a long-term default rather than a stepping stone.

National Association of Realtors

This is not a failure of individual budgeting. It is a structural shift. More households are simply trying to stay afloat, leading to the increase of long-term renters. When public discourse frames affordability as a personal finance issue rather than a systems issue, we miss the broader forces reshaping who can own property and where.

National Association of Realtors

5 ways agents can respond in 2026

Agents cannot solve the affordable housing crisis alone, but they do sit at a powerful intersection of consumer reality, market dynamics and local policy. Here’s where professionals can focus to make a meaningful impact:

1. Reframe ‘Can you qualify?’ as ‘Can you sustain owning a home?’

Affordability is not just about mortgage approval. It concerns whether clients can cover housing costs alongside utilities, insurance, transportation, food and care. Build a full-picture budget conversation into every buyer consult. Educate yourself and your clients on financial tools and resources that will help them get the right mortgage and home for their lifestyle and budget.

The Economic Policy Institute offers a robust family budget calculator that can help shape the conversation and provide the data you need to develop a clear picture.

Your clients can also enjoy free tools and classes offered by their local Habitat for Humanity Chapter to prepare for homeownership. Real estate agents can tap into the RPR tool, which provides extensive financial education on local market conditions and options for their clients to consider.

Finally, ensure you are connected with the best local mortgage professionals who understand what types of mortgages your clients can qualify for.

2. Demystify true housing costs

Helping your clients paint the full picture of homeownership is what will make you an expert that clients send their trusted family and friend referrals, and not just a salesperson who didn’t care about the aftermath of selling them a home.

Utilities and maintenance are deal-breakers when they’re overlooked. Assist clients in estimating real monthly costs: heating and cooling efficiency, average electric and water bills, HOA fees, insurance trends and long-term maintenance.

3. Expand the definition of attainable housing

Accessory dwelling units (ADUs), modular homes, duplexes, townhomes and multigenerational arrangements can unlock pathways to ownership, but only if agents understand local zoning, permitting and financing realities.

Expertise here is quickly becoming a competitive advantage, but it will take an investment of an individual’s personal time to get connected to the framework of their local area’s regulations.

How to become an expert? You need a solid understanding of zoning and restrictions in your area. A great place to start is your local courthouse and zoning office. Alternative housing is often within a certain radius.

There are specific companies and contractors that work with alternative housing, but you will need to research which ones work and ship to your area. Determining whether a parcel of land is suitable for the type of alternative housing you intend to provide to your clients is critical and requires substantial research. Note that supply constraints are often regulatory as well as financial.

Finally, you will need to become familiar with well and septic protocols, how to connect to local utilities and the associated costs. Becoming an alternative housing expert is very similar to custom new builds, so search for a local agent who works with contractors, and ask them to help mentor you with your goals.

4. Engage policymakers, not just markets

Housing is local, but policy shapes supply. Agents have firsthand insight into how shortages affect real families. Share those stories with local and state leaders. Housing outcomes change when the people closest to the problem speak up consistently.

Share your and your client’s frustrations, challenges and barriers. It takes very little effort to write an email or make a phone call. My favorite app for state and national government calls is 5 Calls, which is very easy to use and a great way to get involved in a variety of topics.

5. Partner with mission-driven builders and nonprofits

Get involved at the local level with organizations like Habitat for Humanity that build affordable housing. Agents who understand the home-building process and how to layer affordable mortgage products, grants and other tools will better understand what it will take to make affordable housing happen more regularly in their communities.

The long road back to attainable housing

This is where the dodo bird analogy becomes uncomfortable. Extinction doesn’t occur overnight; affordable housing has been in decline for decades.

This polycrisis needs to be addressed holistically, and there is no single panacea that will fix the issue. The Realtor.com economic research team reported data suggesting that, nationwide, at current construction rates, it would take 7-plus years to build the inventory Americans need for affordable housing.

Here in Virginia, our new governor, Abigail Spanberger, has big ideas about how to change zoning laws to clear the way so more affordable housing can be built, but she will have a difficult sell because this requires a ton of compromise and change by the wealthy, and it’s likely to be a very hard mountain to climb.

The housing industry needs to address the needs of people who require homes, alongside bricks-and-mortar construction, and, without compromise and innovation, affordable housing will continue to move further from more working Americans for generations to come.

Agents and those in the housing industry have a unique opportunity to step up and do the hard work to help advance this issue. The biggest question is: Which ones will take the time to answer the call to save the American dream for not just the wealthiest among us, but also for those who are essential to our everyday lives?

Agents are not just transaction facilitators. At present, they are frontline witnesses to a system that fails more people than it helps. Speak up, get creative and get involved. The clock is 85 seconds to midnight.

If real estate and housing are your passion and your career, and you believe in the American dream, then you should be among the foremost advocates to help all Americans find their way home.

Rachael Hite is a senior housing counselor, writer and thought leader in real estate and aging. Follow her work on Instagram and LinkedIn.