Syndicated post from InmanNews.

Source link

Last week, Intel laid out the state of play in the real estate portal wars as seen through the eyes of the brokerage world.

Broad dissatisfaction with Zillow ruled the day. But the industry’s inability to rally behind a single coherent alternative remains one of the biggest stories in real estate, the most recent Intel Index survey results suggest.

In the concluding chapter of its two-part portal wars series, Intel goes much deeper, gauging not only how agents feel about the main traditional challengers to Zillow’s crown, but also more dramatic possibilities that the entire industry is talking about — from Compass’s private-listing ambitions to Google and ChatGPT’s flirtation with becoming listing intermediaries.

Read the industry’s many-layered thoughts and disagreements on the subject in this week’s report.

Fleshing out the landscape

As explored in last week’s analysis, agents at virtually every brokerage type in December’s survey had a generally negative view of Zillow’s central role in real estate listings.

But when examining the alternatives, clear fault lines begin to emerge across brokerages.

- 35 percent of agents with big, non-franchising brokerage companies — such as Compass, eXp Realty and the Real Brokerage — selected a portal-war endgame scenario where the biggest brokerage companies each built out their own private networks to control their own listings.

- For comparison, only 15 percent of franchise agents and 7 percent of private indie agents said the same.

Instead, these agents were most likely to turn to a united front by MLSs as their preferred portal-war outcome.

- 41 percent of franchise agents and 47 percent of indie agents said they preferred a national home-listing platform run by MLSs to win the day and serve as the industry’s gateway to consumers.

- Only 22 percent of agents at big, non-franchising brokerages said the same.

To get a more granular understanding of the landscape from the agent’s point of view, Intel also sought agent opinions on the biggest players and potential disruptors in the home-listing space.

While there were some differences, agents in big franchise networks tended to view each of the major listing platform players similarly as agents at privately held indies.

But agents at publicly traded, non-franchising brokerages had a distinctly different perspective on the portal wars.

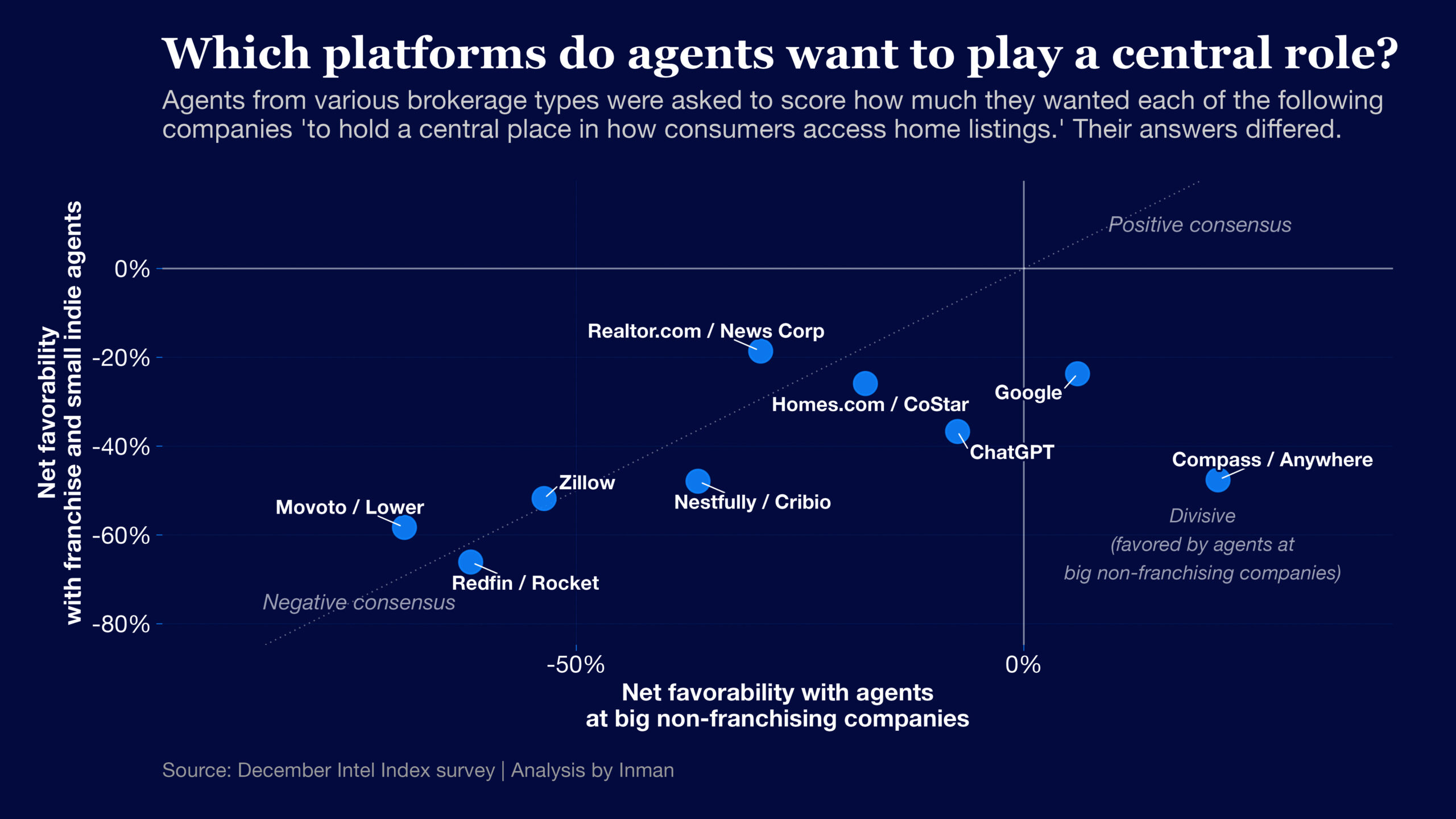

Chart by Daniel Houston

As seen in the chart above, almost every institutional player in the portal wars was viewed with some degree of skepticism and negativity. Within this landscape, the least objectionable challengers to Zillow’s crown from the traditional portal space were Homes.com — with its model of reserving leads for the listing agent on the home — and Realtor.com.

As established before, Zillow itself was one of the least desired parties to remain on top in the portal wars.

But some alternative portal-war winners were particularly divisive within the industry.

Agents with big, non-franchising models were much more likely to view Compass as a desirable central player in the way that consumers access home listings.

- 51 percent of agents for big, non-franchising brokerages told Intel they viewed Compass favorably as a central listing player, while only 29 percent viewed it unfavorably.

- Contrast that with all other agent respondents: Only 14 percent of franchise or private indie agents had a favorable view of Compass having a central listing platform, while 61 percent viewed Compass unfavorably in this hypothetical role.

But Compass isn’t the only major portal outsider that industry insiders have speculated might someday gun for Zillow’s crown.

In December, the web search giant Google captured the industry’s attention as it tested an ad model for partner HouseCanary that brought ComeHome listings directly into search results on mobile. The pilot, which attracted accusations of violating HouseCanary’s agreements with MLSs, appeared designed in part to steer users toward a paid real estate agent partner.

If Google were to make a full play for Zillow’s market share, it could pose a risk to Zillow — which so far has appeared to escape competitor challenges. (Zillow share prices dropped immediately upon the news, and remain 8 percent lower than before it broke.)

But are agents concerned about the possibility of Google and other big tech players swooping into the listing space?

A bit, it turns out. But many see Google and platforms like ChatGPT as a better potential outcome for their business than the Zillow status quo, Intel found.

- 25 percent of agent respondents viewed Google favorably in the role of the chief home-listing provider to consumers, compared with 40 percent who viewed it unfavorably.

- That’s not exactly glowing enthusiasm. But it does reflect significantly more openness to Google than agents have for Zillow, which received support from only 10 percent of agent respondents and opposition from 62 percent.

Agents also seemed to think their businesses might be better off if an AI chatbot like ChatGPT were to seize the mantle from Zillow — and agents at Compass and other big independent models were especially likely to agree.

Why might that be?

Compass CEO Robert Reffkin shared his theory with analysts and investors on a November earnings call.

“What’s great about ChatGPT is it’s bringing the lead flow back to the truth, similar to the way Google did, to the organic path to the best, most experienced agent,” Reffkin said at the time. “That’s a great thing for highly experienced real estate professionals and is a great thing for companies like Compass.”

Still, Reffkin was critical about how platforms like Google have moved toward monetizing the relationship by highlighting sponsored agents instead of guiding consumers based solely on its search algorithm.

This step takes agent search results further away from “the truth,” as Reffkin put it. And similar efforts to introduce ads to chatbot results may be in the cards in the coming months.

One interesting finding from the survey is that there’s a party more reviled than Zillow: the vertically integrated home-transaction platforms under development by the mortgage giants Rocket Companies and Lower LLC. Each of these companies has acquired its own home-listing platform — Redfin by Rocket and Movoto by Lower — in furtherance of this goal.

And agents surveyed by Intel don’t like the idea one bit.

- 4 percent of agent respondents approved of Rocket’s Redfin-fueled vertical platform holding a central place in how consumers access real estate listings, while 69 percent disapproved.

Fewer than 2 percent of agent respondents thought favorably of Movoto playing a central role in the listing space now that it’s owned by Lower, compared to 63 percent who provided a negative response.

Methodology notes: This month’s Inman Intel Index survey ran from Dec. 19, 2025-Jan. 5, 2026, and received 468 responses. The entire Inman reader community was invited to participate, and a rotating, randomized selection of community members was prompted to participate by email. Users responded to a series of questions related to their self-identified corner of the real estate industry — including real estate agents, brokerage leaders, lenders and proptech entrepreneurs. Results reflect the opinions of the engaged Inman community, which may not always match those of the broader real estate industry. This survey is conducted monthly.