Syndicated post from InmanNews.

Source link

One of the nation’s biggest mortgage lenders and mortgage servicers, Newrez, has agreed to pay California regulators $2.3 million in restitution and penalties to settle allegations it overcharged nearly 5,000 borrowers for interest that accrued before their first mortgage payment was due.

The Aug. 18 settlement with California regulators stems from allegations that Caliber Home Loans, which Newrez acquired in 2021, charged excess per diem interest on 4,912 loans between 2012 and 2019.

The company has made refunds totaling $550,316 with 10 percent annual interest, and will pay a $1.8 million fine to the California Department of Financial Protection and Innovation (DFPI).

KC Mohseni

“This penalty holds Caliber accountable and returns interest to California borrowers,” DFPI Commissioner KC Mohseni said in a statement Monday. “It is an example of DFPI’s strong regulatory oversight in California’s mortgage industry and its commitment to protect California consumers.”

Although the settlement requires Caliber to surrender its mortgage lender and servicer licenses in the state, it “does not affect Newrez’s operations in California,” the company said.

“Caliber Home Loans Inc. was acquired by an affiliate of Newrez LLC in 2021 and has since been fully dissolved, including the termination of all related state licenses,” a Newrez spokesperson said in a statement to Inman.

The settlement “relates to activity that occurred prior to the acquisition and is part of the final legal resolution of Caliber’s dissolution,” the company said. “Newrez remains committed to serving California homeowners.”

Before it was acquired by Newrez, Caliber in 2020 agreed to provide up to $17 million in loan forgiveness to borrowers in New York to resolve allegations by Attorney General Letitia James that its loan modification practices put homeowners at risk of default.

After the acquisition, Newrez agreed to pay Minnesota regulators a $54,000 civil penalty in 2022 to settle allegations that Caliber overcharged two borrowers and undercharged a third when it took over servicing their loans from TCF Bank. The settlement also required Newrez to audit all of the other mortgages it took over from TCF Bank after Jan. 1, 2019.

Just last month, Illinois regulators fined Newrez $7,500, alleging that it had failed to complete a loan modification it offered to a borrower in a reasonable amount of time.

In May, Newrez announced that it had hired a former Consumer Financial Protection Bureau official, Mark McArdle, as senior vice president of regulatory relations, public policy and stakeholder engagement.

As assistant director of mortgage markets at the CFPB from 2017 to 2025, McArdle led efforts to modernize Home Mortgage Disclosure Act (HMDA) reporting and update the Ability to Repay/Qualified Mortgage rules, Newrez said.

Baron Silverstein

Hiring McArdle “reflects our commitment to ‘caring fiercely’ for our homeowners and responsible participation in the markets,” Newrez President Baron Silverstein said, in a statement.

2016 exam triggered California case

California regulators said examiners first discovered in 2016 that Caliber had failed to establish a custodial account for borrower’s trust funds as required by law. Instead, the lender was allegedly depositing escrow funds into an operating account.

A review of 38 loans determined that some borrowers had been overcharged for per diem interest, which is the amount of interest that accrues between the closing date and the borrower’s first monthly mortgage payment.

Although the alleged overcharges were small — ranging from $35.29 to $177.54 — regulators said they later determined thousands of borrowers were affected.

California DFPI initially ordered Caliber to perform a self-audit for all loans originated from 2012 to 2016. After Caliber reviewed only 598 loans, regulators issued a demand letter that led to a review of 64,749 loans originated from 2012 through 2019. That review determined nearly 8 percent of borrowers had been overcharged.

A September 2020 examination determined that “Caliber was still overcharging borrowers per diem interest in excess of one day prior to disbursement of loan proceeds,” regulators alleged in a 2024 complaint.

Although the company made refunds to the affected borrowers, it was set to argue its case in an administrative hearing scheduled for Aug. 25 before reaching a settlement.

Newrez servicing more than 4 million loans

Newrez is the nation’s third biggest loan servicer, collecting payments on $864 billion in loans from more than 4 million homeowners as of June 30, according to parent company Rithm Capital.

Last year, Newrez announced that it had earned recognition from Fannie Mae’s “STAR Program” for the second year in a row, an acknowledgement of the company’s “exceptional operations and continued commitment to supporting the full homeownership journey for borrowers nationwide.”

Like rival Mr. Cooper (soon to be part of Rocket Companies), Newrez has invested heavily in AI to lower servicing costs, and improve its “recapture” rate of borrowers who are ready to refinance or buy a home.

The company says its “Rezi AI” engine powers a chatbot that handles 85 percent of digital inquiries without the need to transfer to a human call center operator.

Newrez says it has lowered its annual cost to service a loan from $213 in 2022 to $142 this year, well below the industry average of $228. Over that time, its recapture rate has improved from 41 percent to 57 percent.

Loan servicing generated $233 million in revenue for Newrez in Q2, while loan originations brought in another $86.6 million.

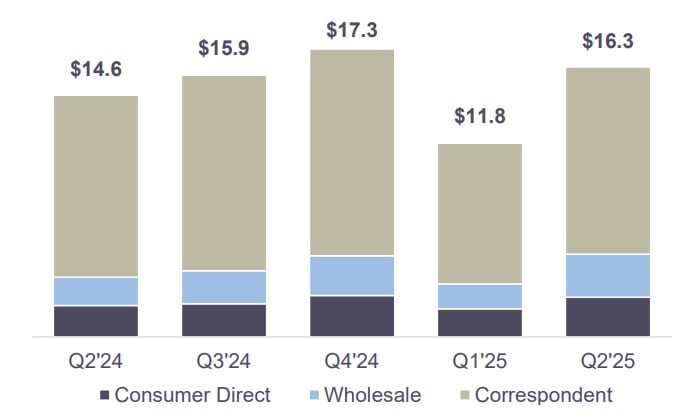

Newrez mortgage originations by channel

Newrez mortgage originations by channel ($ billions). Source: Rithm Capital earnings presentation.

Newrez is also the fourth-largest U.S. mortgage originator, with $16.3 billion in loans funded during Q2, with most of that business ($11.3 billion) done through third-party wholesale and correspondent channels.

Based in Fort Washington, Pennsylvania, Newrez sponsors 750 mortgage loan originators working out of 60 branch locations, according to Nationwide Multistate Licensing System records.

Newrez’s retail and joint venture channel employs loan officers who have relationships with Realtors, home builders and other referral sources. At the end of last year, Newrez’s retail division, including joint venture partnerships with Realtors and homebuilders, employed 453 people at 159 locations.

Newrez’s joint ventures include:

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.