Syndicated post from InmanNews.

Source link

Quick Read

- Pennymac has acquired a minority stake in mortgage software provider Vesta and integrated its cloud-based loan origination system (LOS) into its consumer direct channel.

- The move follows Pennymac’s announcement that it will enter non-QM lending later this month, offering mortgages with flexible income documentation to creditworthy self-employed borrowers.

- Non-QM loans represent about 5 percent of the origination market, estimated at $70-$80 billion annually; Pennymac will offer non-QM loans through its correspondent channels starting Sept. 22, broker direct in Q4 2025, and consumer direct in Q1 2026.

An AI tool created this summary, which was based on the text of the article and checked by an editor.

Correspondent lending and mortgage servicing giant PennyMac Financial Services is looking to provide more loans directly to consumers through a strategic partnership with mortgage loan origination software provider Vesta.

The partnership — which also includes Pennymac taking an undisclosed minority equity investment stake in Vesta — follows on the heels of Pennymac’s Sept. 3 announcement that it’s getting into the business of providing “non-QM” loans to creditworthy self-employed borrowers.

Vesta says its cloud-based loan origination system (LOS) is built on a flexible, open architecture with APIs (application programming interfaces) that allow users to tailor workflows to their unique business needs.

Doug Jones

“Investing in and integrating Vesta’s platform will further strengthen our technology ecosystem, allowing us to deliver an even faster, more intuitive mortgage experience for customers,” Pennymac President Doug Jones said, in a statement. “Early results are very promising, with an increase in efficiency and improvement in our customer experience.”

Founded in 2020 by Blend veterans Mike Yu and Devon Yang in San Francisco, Vesta announced a $30 million Series A funding round in 2022 and had raised $55 million before the latest investment by Pennymac. Backers include Andreessen Horowitz, Bain Capital Ventures, Conversion Capital, Index Ventures and Zigg Capital.

This year Vesta has announced integrations and partnerships with Informative Research, Reggora, Polly, Truv, SettlementOne and Halcyon.

But Pennymac is the first large mortgage client to go live on Vesta’s platform, the companies said Monday.

Mike Yu

“Pennymac is a great partner and a tech-forward leader in the mortgage industry,” Vesta CEO Mike Yu said in a statement. “Like us, they firmly believe that the industry needs state-of-the-art technology that supports a more operationally efficient lending process and Vesta delivers.”

In an investor update, Pennymac said the deal provides the company’s direct lending operations “with a modern, agile platform and leverages our deep network of leading originators across the country to grow the industry’s adoption of Vesta’s LOS.”

Pennymac played a hand in $116 billion in 2024 mortgage originations, making it bigger than Rocket Mortgage but smaller than United Wholesale Mortgage. But the California-based mortgage giant isn’t exactly a household name among homebuyers and real estate agents.

That’s because the company does most of its business as a buyer of correspondent loans that are originated by more than 770 unaffiliated lenders to Pennymac’s specifications. Typically, Pennymac buys mortgages that are insured by the FHA, VA or USDA to be bundled up into mortgage-backed securities (MBS) and sold to investors.

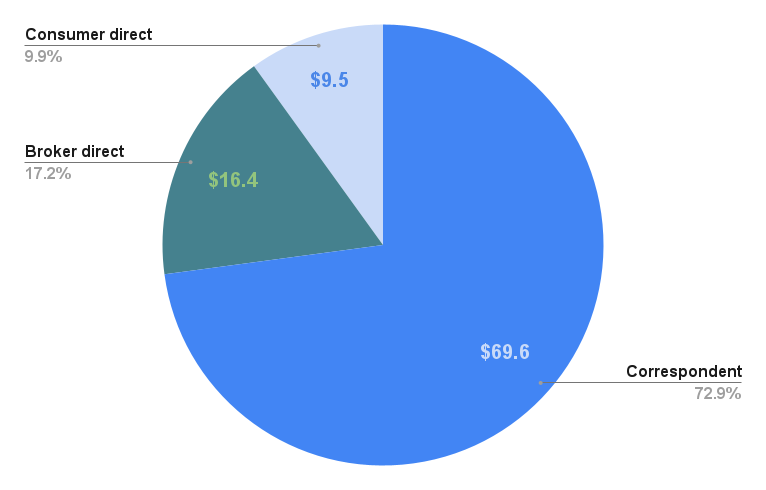

Pennymac 2025 YTD mortgage production by source

Pennymac 2025 YTD loan production through Aug. 31. 2025 by channel. Source: Pennymac investor update.

Correspondent lending has accounted for 73 percent of Pennymac’s $95.5 billion in 2025 originations through Aug. 31.

Pennymac also gets loan application packages from independent mortgage loan brokers, underwriting and funding loans that are also packaged into MBS for sale to investors. The broker direct channel has accounted for about 17 percent of Pennymac’s business this year.

Although those mortgages are also sold to investors, Pennymac keeps the servicing rights, earning fees from MBS investors for collecting monthly payments from homeowners.

Pennymac’s $712 billion mortgage servicing portfolio also helps it do business directly with consumers, when homeowners it collects payments from are ready to buy their next home or refinance.

Although the consumer direct lending channel only accounted for about 10 percent of 2025 originations to date, Pennymac funded $15.4 billion in mortgage loans through that channel when mortgage rates plummeted in 2022.

Pennymac doesn’t have a “brick and mortar” branch network, relying on Internet marketing and call center-based staff to acquire new consumer direct customers nationwide.

The lender says it’s already rolled out Vesta’s platform in the consumer direct channel, with plans to extend the technology to the correspondent and broker direct channels.

Later this month, Pennymac will begin acquiring non-qualified mortgages (“non-QM”) through its correspondent channel, to expand access to flexible financing for borrowers who don’t meet traditional agency criteria.

Non-QM loans are popular with self-employed entrepreneurs and gig workers, who sometimes have trouble qualifying for mortgages that qualify for purchase or guarantee by Fannie Mae and Freddie Mac because they don’t have a steady paycheck.

Pennymac will offer prime (A+, A and A-) non-QM loans to creditworthy borrowers, allowing them to document their income using means including bank statements, asset depletion, 1099, and verbal verification of employment.

Pennymac will market its non-QM mortgages to first-time homebuyers, first-time investors and non-permanent residents, and also offer debt service coverage ratio loans (DSCR) to real estate investors.

After a planned rollout of non-QM loans through its correspondent channel on Sept. 22, Pennymac expects to offer thos loans through the broker direct channel in Q4 and directly to consumers in Q1 2026.

Pennymac estimates that prime non-QM lending represents about 5 percent of the total origination market, with $70-$80 billion in loan production annually.

Alex Boand

“The non-QM space continues to grow, and we’re excited to offer a competitive, high-quality product line to meet demand among our clients,” Pennymac executive Alex Boand said, in a statement.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.