Syndicated post from InmanNews.

Source link

Quick Read

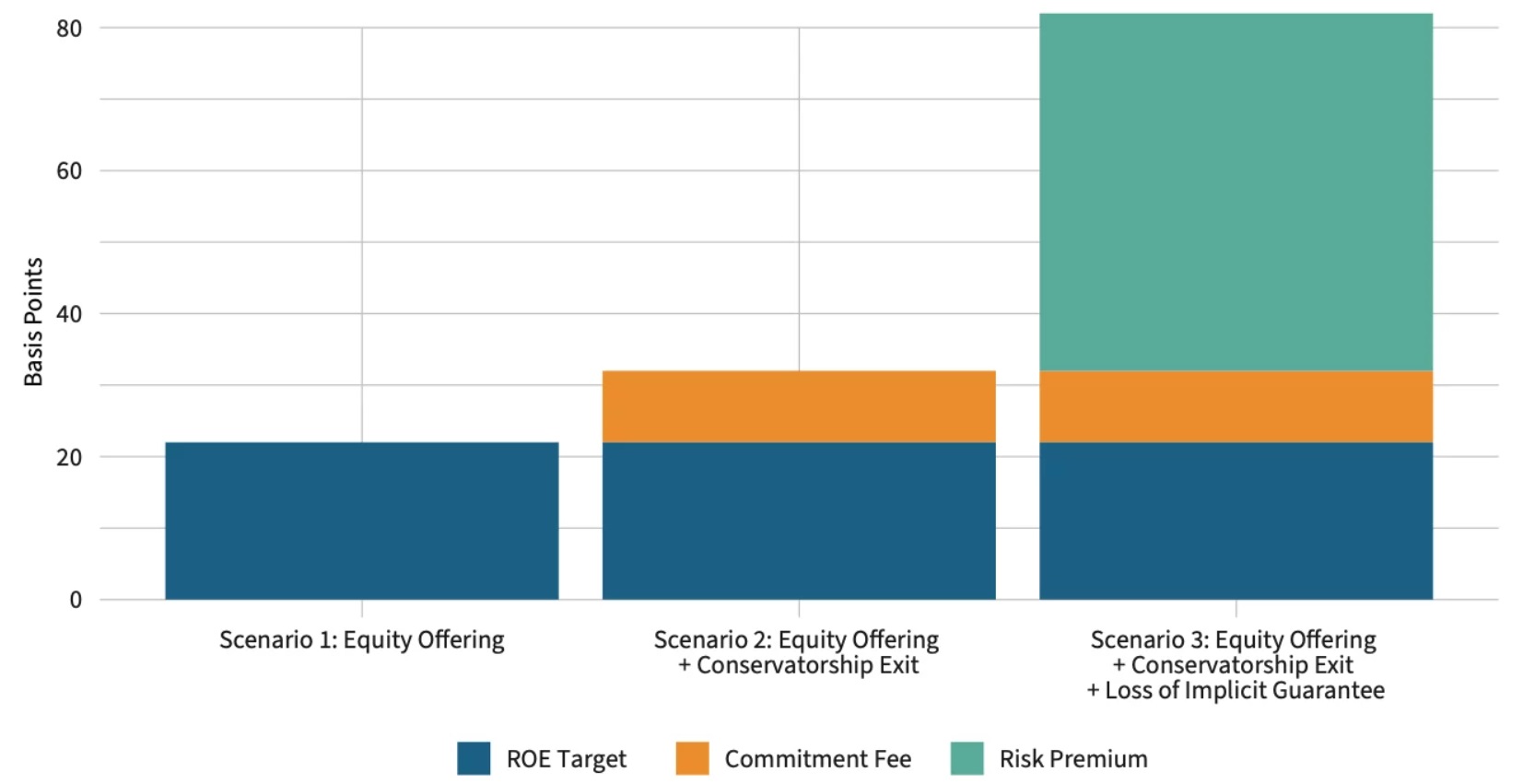

- Stanford Institute analysis finds Trump administration’s plan to sell a small stake in Fannie Mae and Freddie Mac likely raises mortgage rates by only 20 basis points if government backing continues.

- Releasing Fannie and Freddie from conservatorship without an implicit government guarantee could increase mortgage rates by up to 80 basis points, adding $2,000 in annual costs for typical homebuyers

- Maintaining government backing keeps MBS spreads tight and mortgage rates lower; without it, investors demand higher risk premiums, significantly raising rates, especially in stressed markets.

- The administration’s approach, involving partial privatization while retaining regulatory control and guarantees, diverges from full privatization goals and faces uncertainty from investors and industry groups about its long-term impact.

An AI tool created this summary, which was based on the text of the article and checked by an editor.

A plan floated by the Trump administration to sell a fraction of the government’s stake in mortgage giants Fannie Mae and Freddie Mac this year is unlikely to have a big impact on mortgage rates, according to a new analysis by experts at the Stanford Institute for Economic Policy Research.

If the Trump administration keeps tight control over Fannie and Freddie and provides an “implicit guarantee” that the government will stand behind their obligations in times of crisis, mortgage rates might only go up 20 basis points, or 1/5 of a percentage point, Stanford researchers concluded.

That’s the plan Trump administration officials and the president himself have hinted at in media appearances and on Truth Social, where they’ve suggested the government may keep Fannie and Freddie in conservatorship but sell 5 to 15 percent of the government’s ownership stake.

Ever since the mortgage giants were placed in conservatorship in 2008 during the subrime mortgage crisis, small-government conservatives have advocated privatizing Fannie and Freddie altogether, and leaving the housing finance business to the private sector. During his first term, Trump began the process of “recapitalizing” the companies with an eye to privatizing them, but the plan ran out of steam after he lost the 2020 election.

Releasing Fannie and Freddie from government conservatorship — and making it clear that taxpayers won’t bail them out again — might push mortgage rates up by 80 basis points, Stanford researchers Daniel Hornung and Ben Sampson concluded. A basis point is one hundredth of a percentage point.

The Trump administration has been vague about the specifics of its plans for Fannie and Freddie, to the consternation of Democrats. But if the president now seems more intent on monetizing the mortgage giants than privatizing them, administration officials have consistently said that they want mortgage rates to be lower, not higher.

Hypothetical Fannie, Freddie mortgage rate scenarios

An offering of shares in Fannie Mae and Freddie Mac would only bump up mortgage rates by 20 basis points if the government continues to stand behind their obligations, researchers at the Stanford Institute for Economic Policy Research (SIEPR) estimate. Rates could go up more sharply if Fannie and Freddie exit government conservatorship, particularly without an implicit government guaranty. Source: SIEPR.

The Stanford researchers — Hornung is a former Obama and Biden administration economic policy adviser, and Sampson is a doctoral candidate in economics at Stanford University — also looked at a third scenario.

If the government were to sell shares in Fannie and Freddie and release them from conservatorship — but maintain an implicit guarantee — mortgage rates might go up 32 basis points, Hornung and Sampson concluded.

So depending on the path chosen, mortgage rates might go up by 20 to 80 basis points, which corresponds to $500 to $2,000 a year in additional interest payments for the typical homebuyer, they said.

Those projections are roughly in line with estimates Moody’s Analytics Chief Economist Mark Zandi released in June. Zandi concluded that releasing Fannie and Freddie from conservatorship with an implicit government guarantee might push mortgage rates up by 20 to 40 basis points.

But releasing Fannie and Freddie without an implicit guarantee could put more pressure on mortgage rates. Mortgage rates might go up by 60 to 90 basis points, Zandi estimated, because investors in mortgage-backed securities that fund most home loans would demand higher premiums for risk.

How Fannie and Freddie influence mortgage rates

As outlined by the Stanford Institute for Economic Policy Research (SIEPR) brief, Fannie and Freddie impact mortgage rates in two ways:

- MBS spreads: The guarantees that Fannie and Freddie provide to investors in mortgage-backed securities (MBS) mean investors see MBS as safe investments and are willing to accept modest returns.

- Guarantee fees: The fees that Fannie and Freddie charge lenders to cover future borrower defaults are passed on to borrowers in the form of higher mortgage rates.

In theory, the Trump administration could bring mortgage rates down by ordering Fannie and Freddie to cut their guarantee fees, which have been a source of past controversy.

But all three scenarios analyzed by SIEPR assume that in order to offer shares, Fannie and Freddie would have to raise their guarantee fees by 22 basis points in order to deliver a 13 percent return on equity (ROE) to investors, as estimated by the Urban Institute.

If Fannie and Freddie were released from conservatorship, that could add an additional 10 basis points to mortgage rates, Stanford researchers estimate. That’s based on the assumption that the Treasury Department would start collecting a commitment fee from Fannie and Freddie to protect taxpayers in exchange for continued government support.

But the biggest impact to mortgage rates would be if the government decided not to stand behind Fannie and Freddie by providing an implicit guarantee.

In that event, MBS investors would demand a higher risk premium, which the SIEPR brief estimates could push mortgage rates up by half a percentage point.

That’s how much MBS spreads — the difference between yields on 10-year Treasurys and MBS — would be likely to widen even in a healthy housing market with few defaults.

“The stakes would be even higher if the markets were already stressed,” SIEPR researchers warned.

“Although the actual change [in mortgage rates] will depend crucially on the details of any policy package — and it’s possible that well-designed reforms would mitigate mortgage rate impacts to some degree — it is worth noting that the further that any plan deviates from the status quo, the larger the potential for disruption to the mortgage markets,” they concluded.

Other economists have warned that the Trump administration’s efforts to exert control over the Federal Reserve could also rattle MBS investors. If bond market investors lose their appetite for government debt and MBS, that could push mortgage rates higher — even if the Fed cuts short-term rates.

When the Fed cut the short-term federal funds rate by a percentage point at the end of last year, mortgage rates moved in the opposite direction, as economic reports showed inflation moving away from the central bank’s 2 percent target.

Trump’s new take on privatization

Mortgage rates are not the only issue policymers need to consider, Hornung and Sampson warn. Plans to reform Fannie and Freddie should also take into account housing affordability, risk mitigation and taxpayer protection.

If the government does maintain an implicit guarantee of Fannie and Freddie’s obligations, as Trump himself promised in May, that would be a departure from the vision many conservatives have long held for privatizing the mortgage giants.

Project 2025, for instance, advocated that the Treasury Department wind down Fannie and Freddie “in an orderly manner” and move toward privatization to “restore a sustainable housing finance market with a robust private mortgage market that does not rely on explicit or implicit taxpayer guarantees.”

Real estate industry groups like the National Association of Realtors and the Mortgage Bankers Association (MBA), on the other hand, would rather see a “utility-style” model for Fannie and Freddie that provides an explicit government guarantee and limits the companies’ risks and profits.

The Trump administration may also find that its plan to sell a small slice of the government’s 80 percent stake in Fannie and Freddie while keeping the companies under tight control doesn’t appeal to investors.

As former Freddie Mac CEO Don Layton has noted, the government could continue to maintain a majority voting interest in the mortgage giants for years to come. Public shareholders would be largely powerless to raise the fees that Fannie and Freddie charge to lenders — or keep the government from siphoning off profits.

Layton thinks those and other uncertainties might mean that the government would need to issue shares at a steep price discount.

He doesn’t see Fannie and Freddie’s exit from conservatorship as an urgent issue for lenders and homebuyers, however, “as the mortgage markets have long worked well with the conservatorships in place.”

The Trump administration could make ending conservatorship a policy goal, but the issue is “highly technical and largely invisible to the public” and Layton believes implementation could take many years.

In an Aug. 9 Truth Social post, Trump suggested that an offering of Fannie and Freddie shares could occur as soon as November, and that the mortgage giants might even be merged into a single company, “The Great American Mortgage Corporation.”

Fannie or Freddie could issue new shares, or the government could convert some of its senior preferred shares into common shares for sale to the public.

Mortgage industry groups like the MBA and Community Home Lenders of America say competition between Fannie and Freddie is healthy and should be preserved.

Stanford researchers note that technically, the Trump administration could merge Fannie and Freddie without Congressional authorization by placing one of the companies in receivership, allowing the other company to buy them.

Hornung and Sampson maintain a merger would benefit the market “by making it easier to maintain the standardization of practices that has occurred during conservatorship,” such as securitization standards.

On the other hand, they warn, a merger would create a powerful monopoly that could lead to higher guarantee fees.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.