Syndicated post from InmanNews.

Source link

Two closely watched surveys show Americans remain concerned that the U.S. is headed for the dual challenge of an economic slowdown and an increase in inflation.

Real estate is changing fast, and so must you. Inman Connect San Diego is where you turn uncertainty into strategy — with real talk, real tools and the connections that matter. If you’re serious about staying ahead of the game, this is where you need to be. Register now!

Uncertainty over what tariffs the Trump administration will ultimately impose on U.S. trading partners continues to weigh on consumer confidence, according to two closely watched surveys.

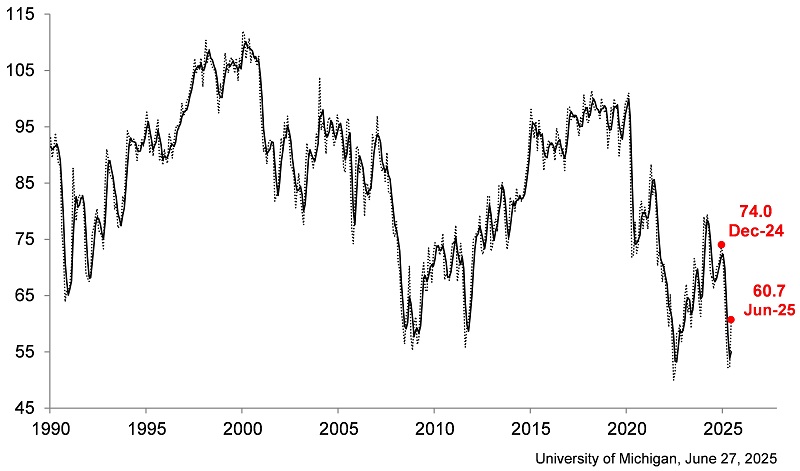

The latest reading from the University of Michigan surveys of consumers released Friday showed consumer sentiment improved for the first time in six months in June, rising 16 percent from May.

University of Michigan Index of Consumer Sentiment

But at 60.7 in June, the U of M Index of sentiment was down 18 percent from December 2024, and “consumer views are still broadly consistent with an economic slowdown and an increase in inflation to come,” survey director Joanne Hsu said in a statement.

Joanne Hsu

“Consumers continue to be concerned about the potential impact of tariffs, but at this time they do not appear to be connecting developments in the Middle East with the economy,” Hsu said.

While rising tensions with Iran initially sent oil prices up by 20 percent in June, they’ve since retreated after attacks on Iran by Israel and the U.S. did not escalate into an all-out war.

The Conference Board Consumer Confidence Index, released on June 24, retreated by 5.4 points in June, to 93. That index had previously posted its first gain in five months in May, rising 12.3 points.

Stephanie Guichard

“Tariffs remained on top of consumers’ minds and were frequently associated with concerns about their negative impacts on the economy and prices,” Conference Board Senior Economist Stephanie Guichard said in a statement. “Inflation and high prices were another important concern cited by consumers in June.”

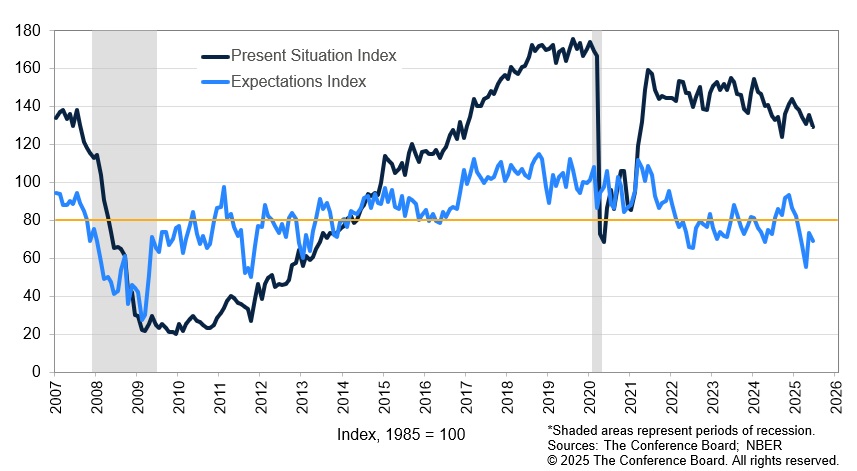

Conference Board Present Situation and Expectations Indexes

The Conference Board’s Expectations Index, which is based on consumers’ outlook for income, business and labor market conditions, fell 4.6 points to 69, well below the threshold of 80 that often signals a recession ahead.

While many economists expect tariffs will have an inflationary impact on prices, they could also cause the economy to slow if consumers buy less and hiring slows.

Federal Reserve policymakers have signalled that while they expect to cut short-term interest rates twice later this year to keep unemployment in check, they’ve been waiting to see what impact tariffs have on prices.

The latest reading of the Federal Reserve’s preferred inflation gauge, the personal consumption expenditures (PCE) index, showed consumer spending shrank by $29.3 billion in May, and that the annual rate of inflation moved away from the Fed’s 2 percent goal, to 2.3 percent.

Ongoing negotiations have added to the uncertainty over tariffs, with the Trump administration pushing back many country-specific “reciprocal tariffs,” which were originally slated to go into effect in April, until July 9.

U.S. stock indexes hit new all-time records on Friday on news that the U.S. and China are close to reaching a trade deal, only to reverse course when President Trump said he was ending trade talks with Canada.

In the meantime, consumers are paying an average effective tariff rate of 15.8 percent on imported goods — the highest since 1936, according to a June 17 analysis by The Budget Lab at Yale.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.